Alibaba: a Breakdown for Online Retailers

Alibaba’s name has splashed across news sites in recent months, drawing hordes of speculation on the impact it will have on the U.S. market. And anyone not paying attention to the hype is running out of time to get caught up, as the group is scheduled to make its record-breaking IPO later this week.

For online retailers, Alibaba’s enormity is a good illustration of the vast size and opportunity presented by Chinese ecommerce, which has recently been deemed the biggest ecommerce market in the world. Some say it will be worth an estimated $541 billion in 2015.

The scope

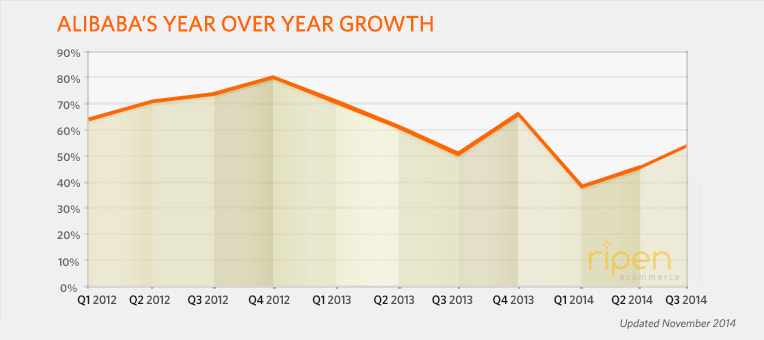

While western retailers weren’t exactly blindsided by the potential of the Chinese market, Alibaba has grown at breakneck speeds. That being said, until results from Q2 2014 were announced, analysts were alarmed by a decline in growth.

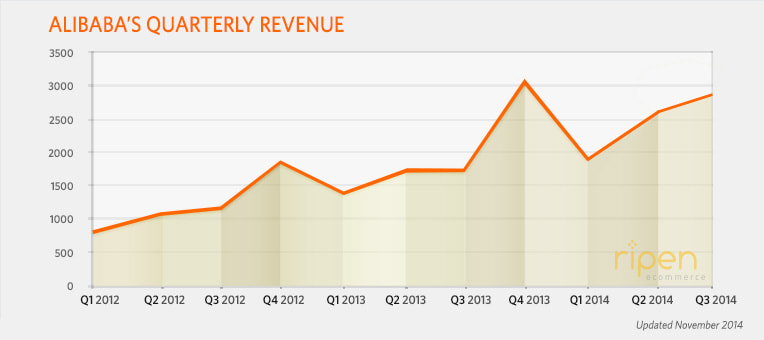

Don’t be fooled into thinking the dip you see here is devastating, however; Amazon historically “only” grows by about 20-25% per quarter and though Alibaba’s growth is slowing down, revenue continues to climb:

Alibaba’s revenue in the second quarter of 2014 increased 46 percent year-over-year to $2.54 billion. Even more impressive: the company sold $296 billion worth of merchandise on its platforms in the 12 months that ended June 30; that’s more than the entire U.S. ecommerce market in 2013.

The puzzle

So what exactly is Alibaba? While most comparisons link the group to Amazon, it’s unfair to consider the two companies exact competitors.

The Alibaba group owns two online marketplaces in China, Tmall and Taobao, as well as a portion of AliPay, the Chinese answer to PayPal. Its original site champions business-to-business sales in a way that no online retailer has been able to in western markets.

Alibaba’s platforms are not only formidable competitors for U.S. ecommerce giants; they offer new opportunities for small and mid-size ecommerce stores to connect with billions of consumers who are already comfortable buying online.

Think of the Alibaba group as a unique mix of Amazon, eBay, and PayPal with a healthy dose of Google shopping. Here is a brief description of each piece of the puzzle:

Alipay

Although the U.S. has been hooked on PayPal, AliPay offers an escrow service, which protects the buyer and boosts customer confidence in the emerging market – something PayPal doesn’t.

AliPay is the number one payment method for online purchases in China. It reduces the complications of local payment processing in a foreign market, making it very attractive for western e-retailers. If you’re selling directly to the Chinese market via your own site, having AliPay as a payment option is a must.

Tmall

Launched in 2008, Tmall provides a brand-friendly marketplace for retailers to sell directly to consumers – most similar to Amazon. It has introduced some of the biggest brands in the world to the Chinese market, including Nike, Samsung, Apple, and Lipton.

U.S. e-retailers will benefit from the marketplace’s brand-friendliness and the fact that it reduces obstacles to reaching a foreign audience. It also has a very merchant-friendly commission rate, making it one of the most attractive channels for retailers around the world.

Taobao

Started in 2003, Taobao is a consumer-to-consumer shopping platform. Similar to eBay, sellers are able to put items up for sale for a fixed price or for bidding. Taobao uses AliPay as its preferred payment method and features advertising for its sister site, Tmall.

Alibaba

Alibaba.com (not to be confused with the Alibaba group) claims to be the largest business-to-business wholesale trading platform in the world. The platform connects manufacturers with buyers, simplifying the grueling process of sourcing new products. It boasts 7.3 million suppliers, 6 million of which are from China.

For most western retailers, Alibaba.com’s primary function is sourcing wholesale products for retail closer to home.

The outlook

With its IPO just days away, it’s clear Alibaba intends to make waves internationally over the coming years. Need proof? Take a look at Alibaba’s first U.S. shopping site, called 11 Main. Launched in June and featuring a clean design that appeals to western consumers, it has already started to compete with domestic companies for online sales.

At the same time, Alibaba founder Jack Ma has said, “China is the ‘main course,’ while developed markets are merely ‘dessert.’” At least in the short-term, Alibaba will likely focus on increasing its reach at home by improving delivery logistics and helping to increase domestic access to the web. This is great news for global brands and small U.S. merchants planning to use Alibaba as a channel to reach the Chinese ecommerce market.

You can read Jack Ma’s first letter to potential shareholders here.

Ripen Services

Expand your ecommerce business into new markets with the in-depth knowledge and planning at Ripen. Our marketing team will optimize your Pay-Per-Click advertising, SEO program, and display advertising to increase your visibility and lead ready-to-buy customers to your site.

Let’s get started.

Find out how we can help your ecommerce strategy.

Get in touch

If you’re a rockstar with big ideas, join our team.