Amazon SEO research study:

What makes a product rank well?

This section explores key observations uncovered as part of our study. Using the following information as a guide, SEO professionals should be able to familiarize themselves with Amazon’s search engine, including what factors influence search results and how product rankings work on the site.

Looking for more Amazon insights?

Download Our Guide to Amazon AdvertisingSales

Winner takes most...

The single strongest correlation we saw was between sales rank (an ordinal ranking provided by Amazon, which is available to the public) and a product’s search engine ranking position (SERP).

In fact, not only did we see a strong correlation between sales rank and SERP, but we also noticed that top selling items had incredible ranking power for a wide range of search queries.

Most SEO professionals familiar with Google know that you can typically target two to three major terms with a page. However, on Amazon as a product’s sales rank improves, the number of search queries resulting in that product also increase.

On average and across our entire dataset, we saw 344,936 unique products for 746,500 search results. This means the average product showed up for 2.2 searches.

However, products in the 99th percentile (top 1%) of sales rank appeared, on average, for 8.7 different search queries, while products in the 1st percentile (bottom 1%) only appeared for 1.2 queries. In other words, the better an item sells on Amazon, the more ranking power it carries for a wider set of keywords.

To be fair, the fact that salesrank is considered in Amazon’s search algorithm is not particularly groundbreaking. In fact, Amazon already acknowledges the site’s relevance rank sorting method (the default method when another is unspecified) factors product sales into its results.

However, Amazon uses more than one sales rank metric. For each of the search indexes, Amazon maintains a sales rank value; we call this a top-level category sales rank. The site also maintains subcategory sales ranks.

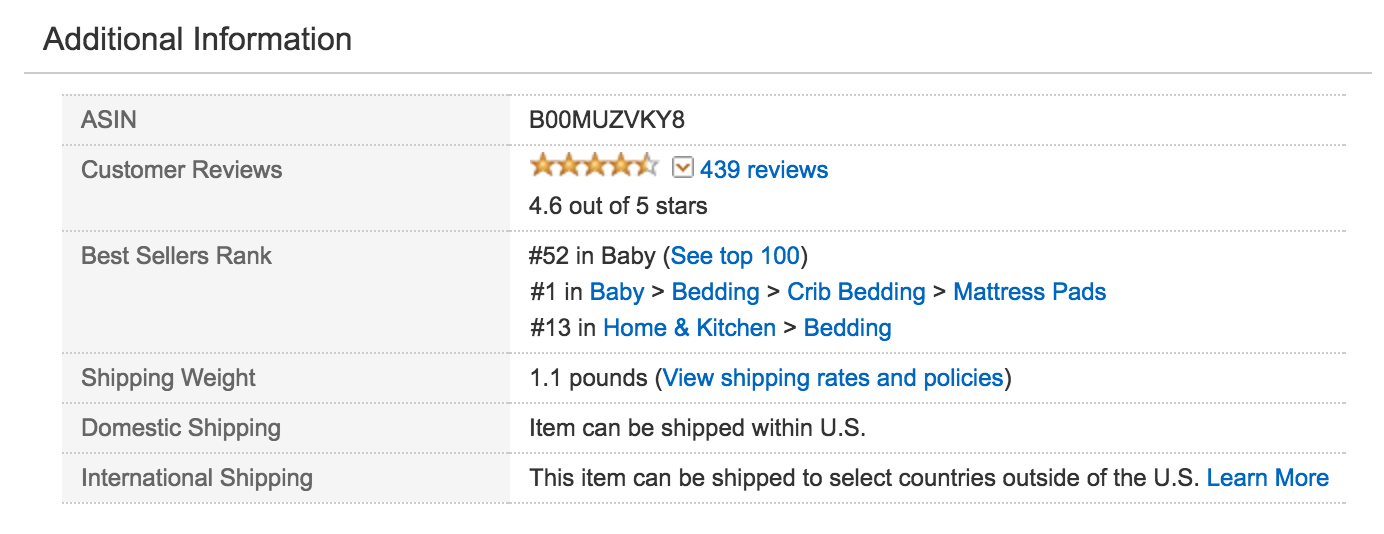

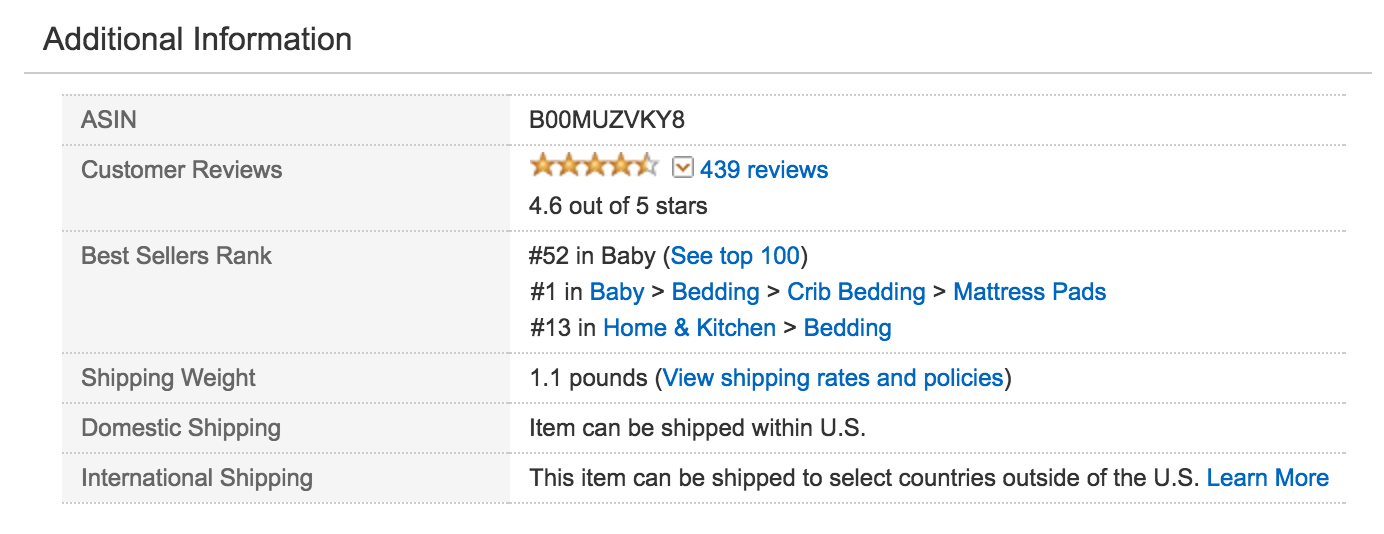

For example, this crib mattress from American Baby is ranked #52 in the baby category - but it’s #1 in the mattress pads subcategory.

It’s possible Amazon maintains even more granular sales ranks beyond the publicly available categories, though this cannot be confirmed by an outsider.

Because our study only investigated each product’s top-level category’s sales rank, and not the appropriate subcategory sales rank, there is a good chance we’ve actually understated the importance of sales for an item in search results.

Get our latest research and weekly ecommerce news!

Categorization

Give your product an identity.

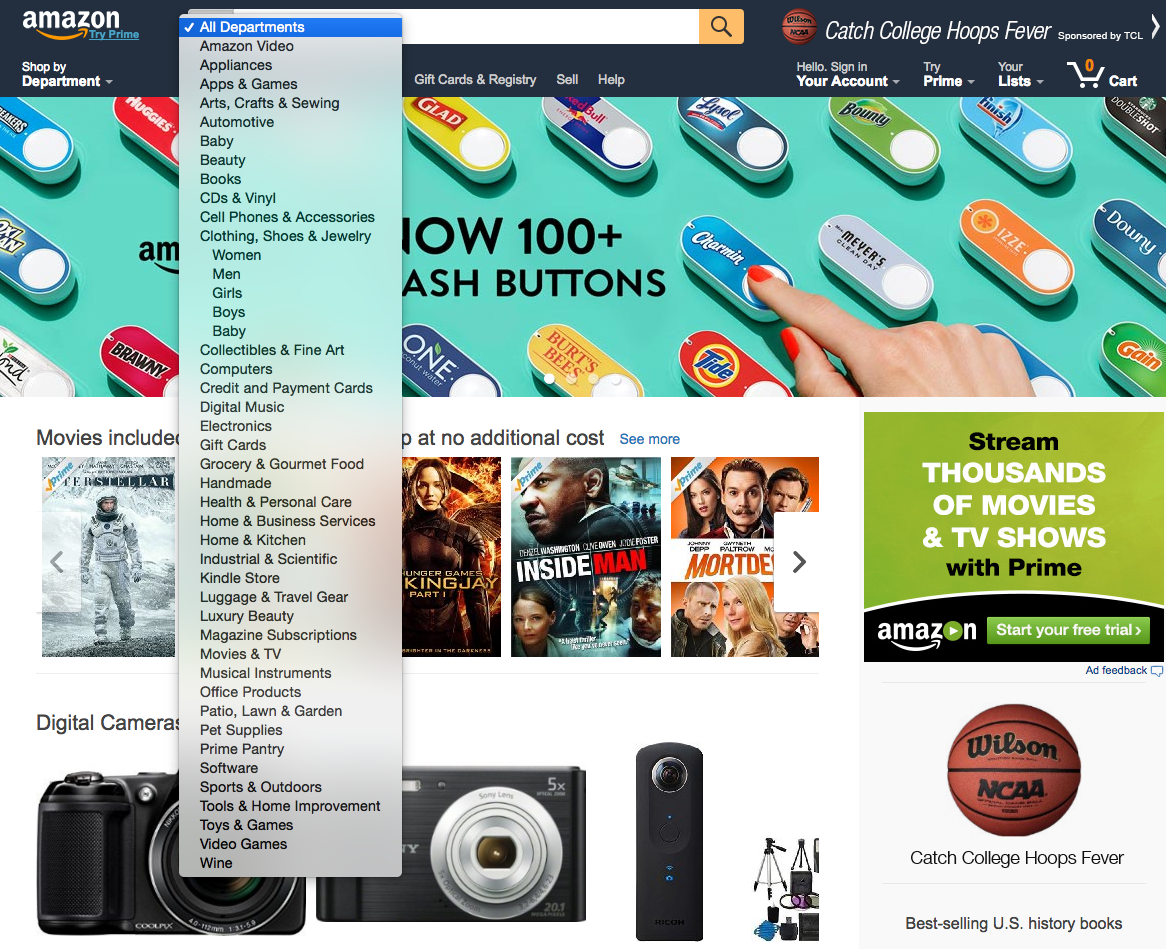

Amazon’s search engine functions entirely based around strict indexes. When a user performs a search on the site, he or she is given the following list of possible categories to choose from:

When a user performs a search without defining a category, a couple of outcomes are possible -

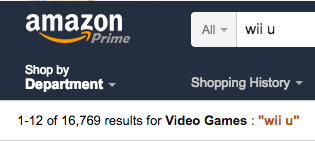

1. Amazon interprets the search query and defaults the user to the category they think is most appropriate. We didn’t define a category in this search for a Wii U, but Amazon interpreted the search and defaulted it to video games:

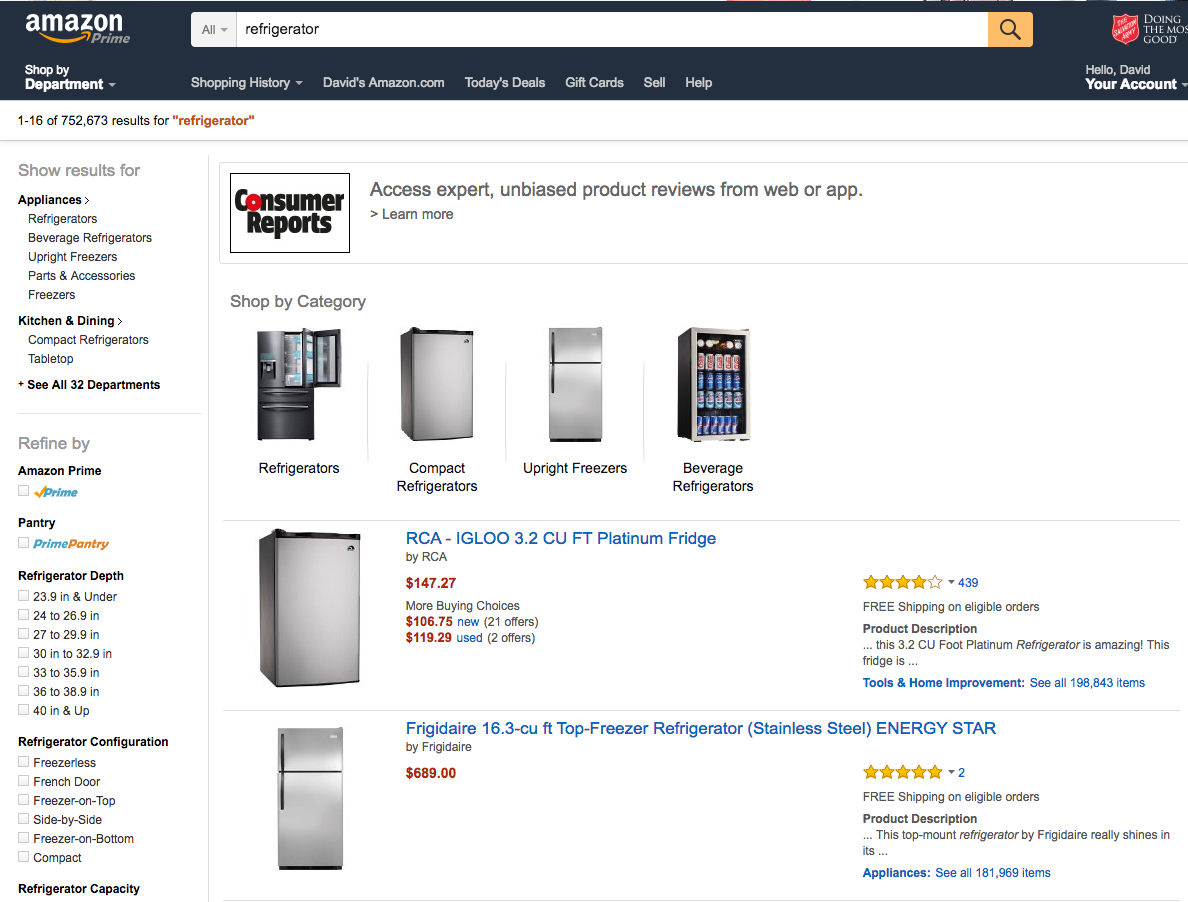

2. Alternatively, Amazon could show the user alternating results from major categories. In this case, we did a search for refrigerator without defining a category:

You’ll notice that there are two major categories appearing here: Appliances and Tools & Home Improvement. What Amazon does in this case is simply alternate the results from one category to the next. So, the results look like this:

- #1 SERP from Tools & Home Improvement

- #1 SERP from Appliances

- #2 SERP from Tools & Home Improvement

- #2 SERP from Appliances

...and so on.

3. Finally, Amazon sometimes shows “truly” blended results from more than one category, like in the example below.

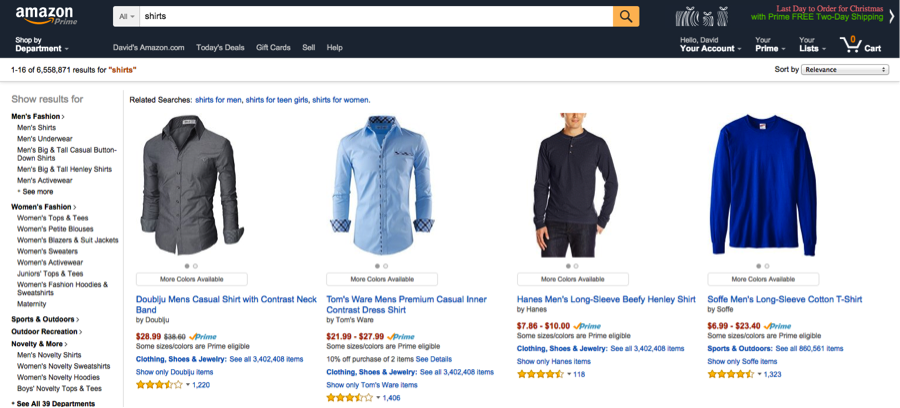

Search results for “shirts” follow this pattern:

- Clothing, Shoes & Jewelry

- Clothing, Shoes & Jewelry

- Clothing, Shoes & Jewelry

- Sports & Outdoors

A little research reveals that Amazon only supports certain indices for what they consider blended search.

Blended search indices in the U.S.

- Apparel

- Automotive

- Books

- DVD

- Electronics

- GourmetFoot

- Grocery

- HealthPersonalCare

- HomeGarden

- Kitchen

- Music

- PCHardware

- Shoes

- Software

- SportingGoods

- Tools

- Toys

- VHS

- VideoGames

In this case, the appliances category that appeared in the search for refrigerators is not supported, which is probably why we see Amazon’s alternate results rather than a truly blended set of results. A blended search, will only ever search blended-search-supported indicies.

What does this mean? No matter which version of the three examples occur for your product, choosing the wrong index can completely rule you out of search results. In this case, optimization is over; you’ve already lost the game before it even began.

Exceptions to the rule

97.8% of the products we looked at in our study only appeared in one search index. That leaves 2.2% of products that are somehow listed in multiple search indexes.

The crib mattress we looked at earlier is an exception to the rule, as it’s listed in both the baby and home & kitchen categories.

Unfortunately, there don’t appear to be any telling signs for how these products find their way into multiple indexes. There’s no way for a seller (or a vendor for that matter) to list a product in multiple indexes.

Our first inclination was that this is something Amazon was doing behind the scenes. If that were the case, you would assume an unnaturally large percentage of these products be shipped and sold by Amazon.com. On closer inspection, though, only 48.5% of these “exception” products are shipped and sold by Amazon. While that is above average (about 35.5%), it’s hardly damning evidence.

However, it is very telling that the products listed in more than one category have dramatically more exposure than those listed in only one category.

On average, we saw these “exception” products appear for 7.29 search queries versus 2.05 search queries for those only listed in one category. Three factors may exaggerate this gap:

- The methodology of our study focused on building diverse head terms, then long tail clusters by search node.

- This set of products is self-selecting and, by definition, they need to appear for at least 2 terms to be included in the segment.

- There may be plenty of products listed in more than one category that our study did not find because of their low visibility.

A word of caution: unless you get Amazon’s blessing on listing a product in multiple categories, we would consider this a black hat SEO technique, simply because what you’d be doing does not align with Amazon’s long term goals and is considered SPAM to their internal teams.

Get research like this delivered to your inbox!

Fulfillment

If you can’t beat 'em, join 'em.

The next biggest factor in search results appears to be your company’s fulfillment relationship with Amazon. Let’s review the options first:

Amazon Shipped & Sold – In this case, you have a vendor relationship with Amazon. You sell the product to Amazon at wholesale prices, and Amazon sells it for whatever retail price they deem appropriate.

Third party sold, Amazon Fulfilled – This is a typical consignment relationship. The product is still entirely owned by a third party seller, but it resides in an Amazon warehouse ready to be picked and shipped when ordered. Amazon calls this program Fulfillment by Amazon (FBA). In most cases, this is the best route for a merchant to sell Prime-eligible products directly to the consumer.

Third party shipped and sold – This is a typical drop-ship relationship. The item is listed for sale on Amazon.com but resides in the seller’s warehouse. When an order is placed, the third party seller picks and ships the item.

NOTE: In May 2015, Amazon introduced Seller Prime, which makes some products shipped from select sellers eligible for Prime, but this is still the exception rather than the rule.

This may seem like a benign choice for Amazon SEO, but we found fulfillment actually has one of the largest correlations with search rankings.

Not only does being shipped and sold by Amazon.com have a relatively strong positive correlation, but the two third-party options also have negative correlations.

As with any study, this correlation does not necessarily equal causation. Amazon has been accused of cherry-picking the best items to be sold by Amazon, so it is possible that the positive correlation we see is just a secondary effect of Amazon choosing to sell top sellers.

In the chart below, we examine the number of products shipped and sold by Amazon by sales rank percentile.

You can see that Amazon does tend to fulfill better-selling products. The trend is even more apparent when you look at the percentage of products sold by Amazon.com versus their SERP.

The correlation versus causation argument could go in circles here. But, the primary takeaway we have is this:

- Allowing Amazon to ship and sell your product is going with the grain rather than against the grain because it aligns best with Amazon’s long-term customer goals as well as financial interests.

- As SEO professionals, we’ve learned time and time again that going against the grain with Google is usually a losing battle, even when short-term gains do exist. We believe the same is and will continue to be true for Amazon.

- In this article on Moz.com, SEO expert Rand Fishkin explains why correlations, not just causation, are important to SEO professionals (and marketers at large). In short, Fishkin argues that learning from the “best” companies is worthwhile even if what you’re studying isn’t the exact causal factor driving increases in SERP.

So, whether fulfillment does or does not directly impact search results is a moot point; the data reveals a strong enough correlation for this to be a significant discussion for any Amazon account strategy.

Not only do we see this trend with items shipped and sold by Amazon.com, but we also see it in general with Prime eligibility.

Earlier, we established that letting Amazon ship and sell your product is going “with the grain,” and the same can be said of Prime eligibility.

In this case, that means securing Prime eligibility by establishing a vendor or FBA relationship with Amazon – or going after the new seller Prime relationship, which is still in its infancy.

Keywords

Not all keywords are created equal.

As far as a correlation with keywords and SERPs, we saw the strongest correlation with product titles. This isn’t surprising as we have direct confirmation from Amazon that keywords in the product title are a ranking factor.

Our metric that describes the quality of a match of the keyword in the product title has the strongest correlation, which means the closer you are to using keywords exactly in the product title, the better.

Surprisingly though, we didn’t see a strong correlation with exact match keywords in the product title. However, this may be exacerbated by the low prominence of exact match keywords appearing in product titles.

Below is a chart of the frequency of exact matches found in keywords by length of the query.

A Note on Length

A great deal of existing Amazon SEO advice suggests keyword stuffing the product title, but we advise against keyword stuffing at the cost of click-through rate.

Earlier we identified how strongly correlated sales rank is with SERP, which means two other well-known marketing metrics are indirectly correlated to better SERPs as well. They are:

- Click-through rate

- Conversion rate

While it may be true that you can “target” a wide variety of terms with your product title, this may be counterproductive if you forsake click-through rate on your most relevant terms in exchange for trying to appear for a wide variety of keywords.

Additionally, there seems to be no supporting evidence to suggest that a long, keyword-stuffed product title leads to ranking for multiple search queries. In fact, the best selling products appear to have a slight bias towards shorter product titles.

We looked at the 1% of products that appeared for the widest collection of search queries; these products appeared as a result for 15 or more search queries in our study, on a really wide collection of terms. On average, these product titles were only 77 characters long and 84.2% of the product titles were less than 110 characters in length. The reason we chose 110 characters is that Amazon seems to truncate product titles after about 110 characters on desktop (though this probably varies with character size). If we look at the 99th percentile of top selling products on Amazon, we see that 89% of their product titles are less than 110 characters on desktop.

Below is a chart of the percentage of product titles that were 110 characters or less by their sales rank percentile:

If we look at mobile, we see product titles getting cut to around 74 characters in the Amazon app and around 81 characters on mobile web.

Mobile web:

Mobile app:

While still only looking at the 99th percentile of best selling items on Amazon, we calculated that 71.5% of these products have product titles that are 74 characters or shorter.

What this tells us is that the best-selling products on Amazon use titles to clearly communicate the product to the consumer, rather than using their titles to gain advantage in Amazon search.

We can’t disprove the idea that a keyword-stuffed title can enable you to rank for a wide variety of terms, but we can conclusively say that the top performers on Amazon do not appear to be widely using that tactic. Instead, they seem to have a slight bias towards a shorter product title better suited for click-through rate.

Given this observation and the ones before it, we would advocate using core keywords in a product title but ultimately optimizing for click-through rate.

About “Child” Products

It’s extremely important to know that for a product variation, Amazon will automatically locate the child ASIN and display it in search results when the query is relevant. For example, this search for a “comforter” shows this product with the full/queen size in the product title. However, if we modify the search query to be “red comforter twin” we now see the same product listing appear with the twin-size child ASIN’s product title and the red image displayed.

For this reason, we would encourage Amazon SEO professionals to use special characters like hyphens, parenthesis, and pipes to help structure a product title that quickly communicates the most essential pieces of information to the consumer. But, also to remember that maintaining images and titles for every simple ASIN attached to a product is critical.

Description and Features

According to our data, keyword usage in the description and features does not appear to have very strong impact on search results. We also know from Amazon’s own description of relevance rank that their algorithm does consider keyword usage in the description field. In other words, it appears that keyword usage in the description and features fields can get your product indexed for a given keyword, but keyword usage in these fields does not appear to have a significant impact on ranking better for competitive search terms. For that reason, we recommend using the description and features fields primarily for these two purposes:

First and foremost, for conversion: These fields should promote the most compelling product possible. Amazon’s description fields do support basic HTML, so you should consider using it for copyediting techniques like line breaks and bulleted lists.

For long tail search optimization: similar to the body text of a given article and traditional search engines, Amazon’s description and features fields will index products for keywords, so relevant copy can help your product turn up for a variety of keywords that you otherwise might not have been.

For instance, this Nano USB Wi-Fi widget is compatible with Raspberry Pi, a popular computer board for do-it-yourself computer and robot hobbyists. This item currently ranks #9 for a “USB Wi-Fi raspberry pi” search, and it does so without mentioning Raspberry Pi in the product’s title.

This is most likely how we would optimize a product if use with Raspberry Pi represented only a small fraction of the product’s target market.

Advertising

"Organic" for a price.

In modern day SEO, organic and paid search theoretically have a church and state relationship. That is to say, they’re separate disciplines, and paid advertising should not influence organic search results.

In Amazon SEO however, sales rank has such a significant impact on SERPs that organic rankings can be, and frequently are, indirectly manipulated by ad spend.

In our opinion, this is yet another example of why Amazon vendors have a significant advantage over Amazon sellers. Amazon’s vendor advertising platform gives users access to ad inventory that sellers do not have, and vendors also have significantly less competition for that ad space.

In our own experience, we’ve seen Amazon vendor ad campaigns deliver more than a 100:1 return on ad spend with a half a million sales in a single month. This is scale and return that should get any vendor excited. Of course, the market for vendors can be highly competitive as well, but we also find significantly more early adopter opportunity on the vendor ad platform than the seller platform.

Looking for how to advertise on Amazon?

Download Our Guide to Amazon AdvertisingDiscounts

Less is more - but not by much.

Amazon constantly comes under assault over its pricing policies, which raises the question- Do discounts matter for Amazon SEO?

In short, our study did find a positive correlation between larger discounts and better SERPs. However, the value of R for this correlation was only 0.04, which is relatively small compared to some of the other factors we’ve discussed. You can see all R-values in the correlations section of this report.

It’s ironic to note that, as often as Amazon is thought of as a discount retailer, we found that 5.2% of products we studied were actually being sold above list price. (44.5% of products were sold at a discount compared to the list price.) Here’s what the distribution of discounts looks like:

In this case, to assume any kind of cause and effect relationship would be quite a jump. Here are a few theories that could explain the correlation:

- Top sellers attract lots of competition, which often results in a price war. In this case, the correlation is more of a secondary effect of the competitive nature of top selling products.

- List price is only ever provided when the selling price is below the list price. Meaning our study was unable to account for negative discounts (selling above list price). This skews the results in favor of discounts.

- There may be a psychological benefit to selling below list price. If discounts entice consumers to complete their purchases, it would be increasing sales. Again, the correlation would be a secondary effect related to sales rank.

- A mix of the factors above.

Given the lack of strength of the correlation and murkiness of what causes the link between discounts and SERPs, we would not recommend listing products at a discount simply for the purposes of SEO.

Optimization

Amazon SEO has a snowball effect.

While “optimization” is not a ranking factor in and of itself, it’s very important to understand that when it comes to Amazon SEO, optimization is like a snowball. More specifically, because sales rank so greatly impacts the ranking potential of a given product, there is a compounding effect to optimizing a product detail page.

Whether optimization influences conversion or search, if it results in any lift in sales, the product’s exposure in search is likely to increase as well:

This means that optimizing for both click-through rate and conversion rate both have an indirect but important relationship with your SERP, and obsessing over conversion rate optimization will help you rise to the top of the search results.

Exclusions

Omitted from our study.

Due to some technical limitations encountered during data collection, we were unable to consider a few important metrics in our study. For details on how we collected our data, check out the methodology section of our report.

Reviews

As most of us know, Amazon guards its review data religiously. In the future, we hope to be able to explore correlations that probably exist between product reviews and SERPs. Here are a few specific data points we’re interested in:

- Average rating

- Total number of reviews

- Total number of verified reviews

- Keyword mentions in review text

- Qualitative factors, such as review length of featured reviews or number of users that found the review helpful

Search Terms

When a user creates a marketplace listing, he or she is given five search term fields to fill with keywords. Since this is not a publicly available field, we were unable to detect a correlation between search terms and SERPs.

Target Audience

When listing an item, users are also able to choose a target audience, such as teens, adults, seniors, etc. Again, this data is not publicly available so it was omitted from the study.

Platinum Keywords

These are keywords only available to platinum merchants. The keywords are meant to specify areas in Amazon’s browse tree that the ASIN should found under. We’ve read many comments on forums that this is one of Amazon’s best-kept secrets, and we tend to agree. That being said, there seems to be little to no public knowledge on how these keywords actually work, so we could not incorporate them into our research.

Let’s get started.

Find out how we can help your ecommerce strategy.

Get in touch

If you’re a rockstar with big ideas, join our team.